65 000 ₽

реальный ежемесячный доход

27 500+

исполнителей зарабатывают с нами

300+

компаний ищут исполнителей

760+

заданий размещаются ежемесячно

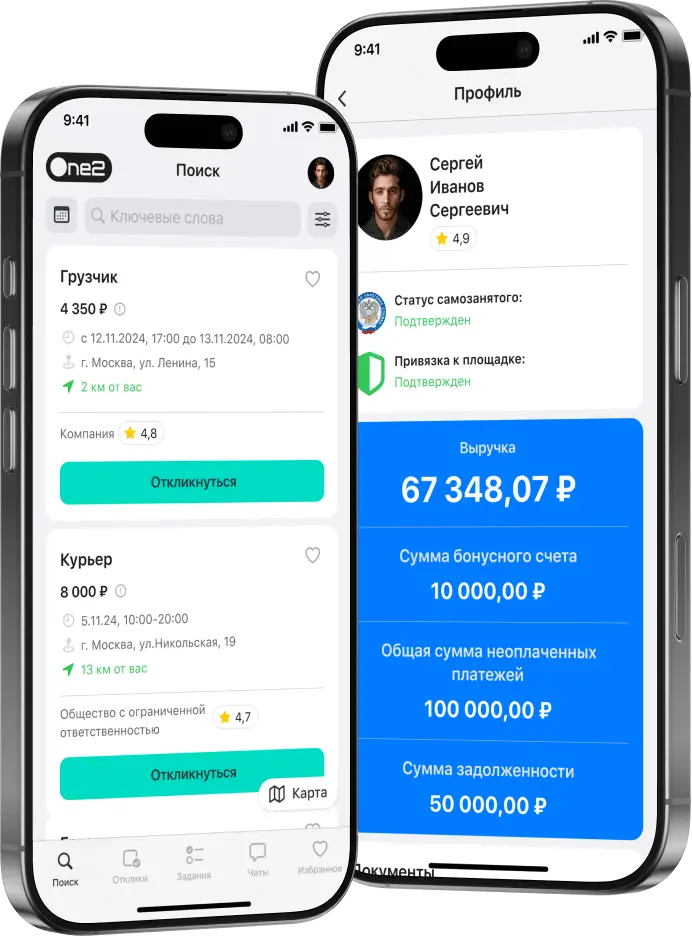

Большой выбор заданий

Быстрые выплаты

Надежные заказчики

Доступ в любой точке города

Прозрачный доход

Гибкая занятость

Как это работает

Скачайте приложение

И начните получать доход прямо сейчас на вашем устройстве

Как это работает

Что для этого нужно

Самозанятость

Чтобы начать получать доход на нашей платформе, вам нужно получить статус самозанятого. Вы можете легко это сделать в приложении Мой налог

или на сайте ФНС

Паспорт

Являясь оператором персональных данных, мы гарантируем их безопасность и конфиденциальность

Банковские реквизиты

Перевод денежных средств осуществляется на карты любого банка с помощью СБП, расчетного счета или номера карты

Медицинская книжка

Она может понадобиться для определенных категорий услуг

* оформление мед.книжки не является обязательным процессом

Присоединиться к платформе

Как стать самозанятым

1. Скачайте приложение “Мой налог”

2. Зарегистрируйтесь по инструкции

Налоговый калькулятор самозанятого

Используйте онлайн калькулятор, чтобы мгновенно рассчитать налог с доходов от юридических лиц c учетом вычета

Налог с учетом вычета

0,00 ₽Налоговый вычет

0,00 ₽Остаток вычета

0,00 ₽- 01

Введите сумму доходов от юридических лиц

Процент налога для самозанятых при сотрудничестве с юридическими лицами и ИП составляет 6%

- 02

Введите остаток суммы налогового вычета, если есть

Вычет от государства в размере 10 000 р снизит налог до 4% для доходов от юридических лиц и ИП

- 03

Узнайте результат

Калькулятор расчета налога автоматически в режиме онлайн покажет размер налога с учетом указанных доходов, ставки налога и налогового вычета

Ответы на вопросы

Кто такие «самозанятые»?

Зачем становиться самозанятым?

Можно ли оформить самозанятость и работать по трудовому договору одновременно?

У меня нет медицинской книжки, могу ли я работать?

Сколько времени нужно уделять заданиям?

Можно ли брать задания в разных компаниях?

Сколько я смогу заработать?

Как быстро приходят деньги за задание?

Документы

ИНН 5433966474, ОГРН 1185476026966

Уведомление об использовании файлов куки (cookie)

Мы используем cookie-файлы, чтобы обеспечить корректную работу нашего сайта, и улучшить качество наших услуг. Продолжая использовать наш сайт, Вы соглашаетесь с использованием cookie-файлов.